The cabinet opens Rs 25,000 crore window for projects that are on hold.

In order to reactivate the main industry, also to boost the economy and to provide aid to home buyers, the cabinet approved Rs 25,000-crore special windows to finance housing projects that are stalled. The money will be available for projects that are “net worth positive,” FM Nirmala Sitharaman said.

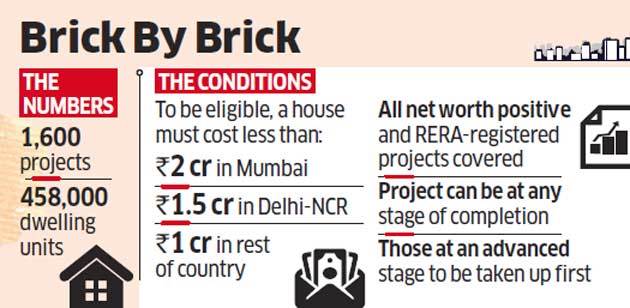

There will be potential distribution to include as many as 1,600 projects with 458,000 housing units. In addition to sovereign wealth funds and pension funds, the Government will contribute Rs 10,000 crore and the rest is from LIC and the State Bank of India.

The formation of a special window for affordable and medium-income housing projects may revive the real estate sector and creates substantial employment.

In a release, the government said that this would generate jobs and increase demand for cement, iron and steel. “This move will also have a positive impact on other key sectors of the Indian economy in releasing pressure”. Sitharaman said that an SBI Caps account will be formed to manage projects and release funds.

Incomplete housing units of less than Rs 2 crore in Mumbai; less than Rs 1.5 crore in Delhi-NCR, Chennai, Kolkata, Bengaluru and Pune; and under Rs 1 crore in other parts of the country will be eligible. Sitharaman said, “There is now relief for all those projects within the categories of affordable and middle income.”

Issuance of Clarificatory Note by the RBI:

After a cabinet meeting chaired by PM Narendra Modi on Wednesday, Sitharaman spoke to journalists.

“This will eventually help to alleviate the financial stress that many middle-class home buyers have faced, who have invested their hard-earned money,” the government said.

Sitharaman said that any project, regardless of the completion phase, shall be eligible if it is of net worth positive and has a Real Estate (Regulation and Development) Act or Rera registration.

The government had addressed the non-performing assets (NPAs) in depth with banks and the Reserve Bank of India (RBI). “On this matter, the central bank will issue a clarificatory not,” she said.

On 14 September Sitharaman announced the fund but was limited to granting last-mile funding for projects that aren’t in the bankruptcy court or have already been listed as bad debt. Following extensive consultations with builders and homebuyers, the conditions are now been relaxed, she said.

A government official said the total value of the stuck houses is estimated to be Rs 1.39 lakh crore, and it will require around Rs Rs 55,000-Rs 80,000 crore for the completion.

- Affordable Homes

- Bangalore

- Cement

- Chennai

- Construction Industry

- Current Affairs

- Delhi

- Expert Views

- Experts

- Features

- Housing Socieites

- INDIA / WORLD

- Infrastructure

- Interviews

- Investments

- Lifestyle

- Mumbai

- NCR Region

- New Projects

- News

- News Launches

- Other Cities

- Project

- Property Updates

- REAL ESTATE NEWS

- Realty_Quarter

- Residential property

- World Real Estate News