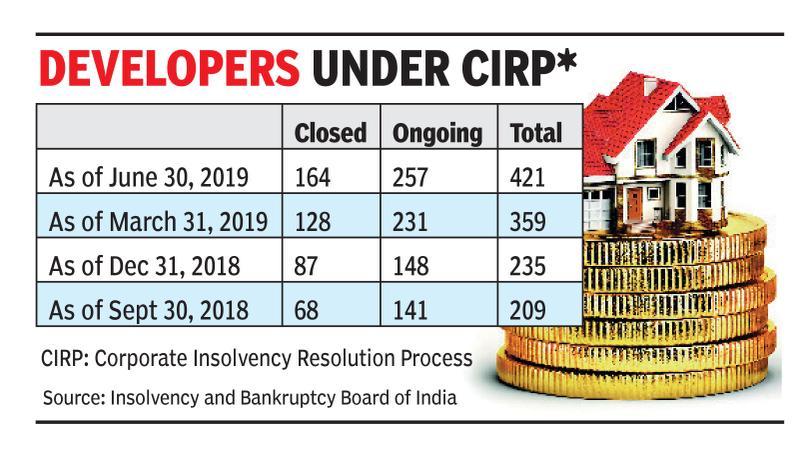

Almost 421 realtors were under the bankruptcy court, doubled then the last year.

Due to a sustained sales drop and the ongoing liquidity crisis, the number of property developers brought into the bankruptcy court has more than doubled in the past one year.

Data from the Insolvency and Bankruptcy Board of India demonstrates for the period of June 30 in which more than 421 realtors were under the Corporate Insolvency Resolution Process (CIRP) which has been increased from 209 as of September 30 of the previous year.

Out of the 421 cases, 257 are still going, and the rest are closed, which means these have been withdrawn or the companies were liquidated. Unless the liquidity crisis is reversed, experts say, the number of persistent cases will continue to increase.

Second highest after the manufacturing industry, these statistics show the poor state that has been hammered on the Indian residential market for half a decade.

Initially excess inventory triggered the recession, which then affected the sector from demonetisation, RERA implementation and GST implementation, as well as the IL&FS crisis, which stopped NBFCs from providing loan to real estate.

The working capital requirements have been financed by lenders. This is has stopped due to the NBFC crisis. The majority of developers brought to court were unsustainable, and it was already a bad situation in the past 10 years where they were borrowing just to pay the interest. In the absence of funds, developers were not in a position to complete projects.

NBFC funds tanked 73% to USD 140 million in the first half of the year compared with USD 520 million in the previous year, because, RBI tightened its lending norms to those institutions and to Housing Finance Companies (HFCs) following the IL&FS debacle, according to data from Anarock property consultant.

Slow sales and a record-breaking unsold stock have reduced developers’ cash flow. In the third quarter, housing sales in the top seven cities contracted 20%, compared with the previous one, that was 55,080 unit. The inventory stood at 6.6 lakh units at the same time.

Anarock Chairman Anuj Puri said, “The liquidity crisis has brought down these developers.” While the government instructed banks to arrange loans to boost consumer demand in the agricultural, automobile, home and education sectors, it still remains to be seen whether builders could make a turnaround in the current festive season.

“The long recession has taken us to where we are. We’re in the long winter if things don’t get better until January,” said Chintan Patel, partner, deal advisory – real estate & hospitality at KPMG in India.