Spurt in demand for affordable housing pushes up overall residential sales

Residential sales grew by 4% in H1 2019; Launches rise by 21%, nationallyResidential sales grew by 4% in H1 2019; Launches rise by 21%, national office space supply and transaction volume at an all-time high; Co-working spaces account for 15% of volume in H1 2019.

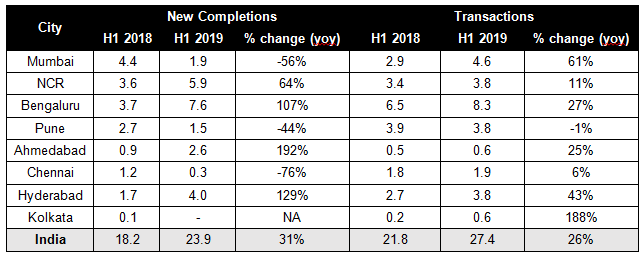

Knight Frank India today launched the 11th edition of its flagship half-yearly report – India Real Estate. The report presents a comprehensive analysis of the residential and office market performance across eight cities for the period January – June 2019 (H1 2019). The report findings establish that office space market experienced decadal high (half yearly) volume in supply and transactions in H1 2019. Office supply increased by 31% year-on-year (YoY) to 2.2 mn sq m (23.9 mn sq ft) in the current analysis period, the highest level achieved in this decade. While transactions were recorded at 2.6 mn sq m (27.4 mn sq ft) higher by 26% YoY in H1 2019. Co-working space providers have taken up approximately 0.37 mn sq m (4.0 mn sq ft) of office space during H1 2019, a 42% growth over H1 2018.

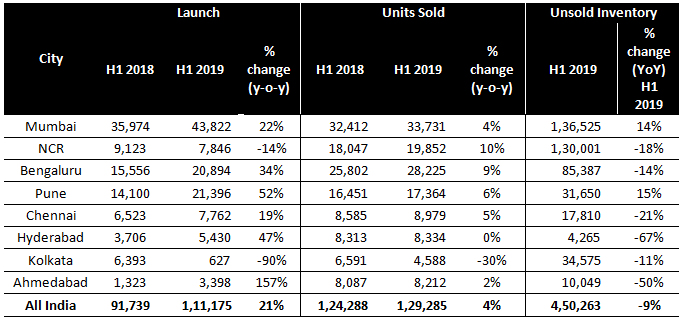

Residential unit launches in H1 2019 increased by 21% year-on-year (YoY) to 0.11 mn units while sales grew by a steady 4% YoY to 0.13 mn units. The residential market witnessed growth in supply as well as sales for the third consecutive half year period, both hitting their highest level since demonetisation during H2 2016.

RESIDENTIAL MARKET HIGHLIGHTS FOR TOP 8 CITIES

- Regulatory environment boosts market volumes; H1 2019 saw launch new units rise by 21% YoY to 107,143 units while sales grew by a steady 4% YoY to 133,317 units.

- 51% of launches during H1 2019 have occurred in the ticket sizes under INR 5 mn (INR 50 lakhs) and 78% under INR 10 mn (INR 1 Cr) as developers’ keenly focus on affordable housing and lower ticket size as they are demand appropriate.

- NCR and Kolkata saw a drop in unit launches in H1 2019 while supply volumes in Ahmedabad vaulted by a massive 157% for the same period. Hyderabad and Bengaluru grew by 47% and 34%, respectively.

- The all India sales improved by 4% in H1 2019 making this the third consecutive quarter to record sales improvements. The trends conclusively show a general arrest of a declining trend that can well be the inflection point leading to growth of sales in the market.

- The Mumbai residential market recorded the largest sales volume among all the cities, the most YoY growth was experienced by NCR at 10% during H1 2019.

- The Kolkata residential market experienced poor traction both in volumes of launches and sales that declined by 90% and 30% respectively. This is primarily due to the procedural delays caused by the West Bengal Housing Industry Regulatory Authority and the pronounced dependence of developers on the distressed NBFC sector.

- Weighted average prices have stagnated across cities with Mumbai, Pune and Chennai seeing prices fall by a further 3%, 4% and 3% YoY, respectively. Hyderabad continues to see exceptional price growth at 9% YoY due to the high proportion of ready inventory and very little supply coming online during 2018.

- During the last four years, the growth in residential prices in most of the top eight cities of India has been below retail inflation growth and the gap has progressively increased since H1 2016. This has helped keep the end-user interested and arrested the downward sales momentum as compared to launches. Hyderabad has been the only market to buck the trend and recorded residential price growth over the retail inflation level.

- Unsold inventory across top eight markets recorded a decline of 9% YoY in H1 2019. While Hyderabad saw a decline of 67% in unsold inventory, Mumbai was the only market to record an increase with inventory overhang increasing by 14%.

INDIA RESIDENTIAL MARKET SNAPSHOT

Source: Knight Frank Research

Shishir Baijal, Chairman and Managing Director, Knight Frank India said “The concerted efforts by the government and the incentives given have resulted in substantial demand in affordable housing which has resulted in an overall boost to residential sales. This also seems to be in line with the government vision for “Housing for All.”

~ end ~

OFFICE MARKET HIGHLIGHTS FOR TOP 8 CITIES

- Supply increased to a decadal high 2.2 mn sq m (23.9 mn sq ft) recording a rise of 31% YoY.

- Transaction levels also recorded a similar decadal high of 2.6 mn sq m (27.4 mn sq ft) for space transacted in a single period during H1 2019 due to demand from IT/ITeS and Co-working spaces.

- Bengaluru hits historic high in transactions as well as supply during H1 2019 with transactions hitting 8.3 mn sq. m. while supply increased by over 100% at 7.6 mn sq. m. in H1 2019.

- Average rental values across the eight cities grew at by 10% YoY during H1 2019. Ahmedabad experienced the maximum YoY rental growth of 14.3%, while Bengaluru and Hyderabad grew at 13.5% and 11.3% YoY respectively.

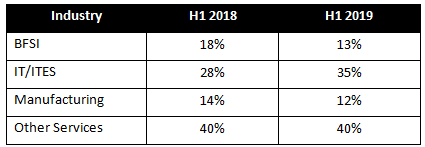

- The IT/ITeS sector accounted for 35% of all transactions in H1 2019 as compared to the 28% in H1 2018 whereas, share of BFSI declined 13% in H1 2019 as compared to 18% in H1 2018 as Non-Banking Financial Companies’ (NBFCs) and banks with higher NPAs to curb expansion plans and liquidate non-core assets.

- Co-working space providers have taken up approximately 0.37 mn sq m (4.0 mn sq ft) constituted about 15% of all transactions across top eight cities during H1 2019, a substantial increase of 42% over H1 2018.

- Strong demand scenario in office market keeps the vacancy stable at 13% in H1 2019, compared to a year ago. Southern markets record single digit vacancy rates, with Bangalore showcasing the lowest vacancy rate at 4% n H1 2019

INDIA OFFICE MARKET SNAPSHOT

SECTOR–WISE SPLIT OF TRANSACTIONS

Note: BFSI includes BFSI support services

Shishir Baijal, Chairman and Managing Director, “Double digit rental growth in five out of eight markets reiterates the underlying strength of Indian office market. The spurt in demand for higher end roles in the Artificial Intelligence and data security domains have led to a welcome and significant 59% YoY increase in demand from the IT/ITeS sector during H1 2019. Co-working spaces continue to drive transaction volumes and influence occupier demand”