Over 50% of developers exit the real estate market in top 9 cities.

By Abhay Shah, Realty Quarter

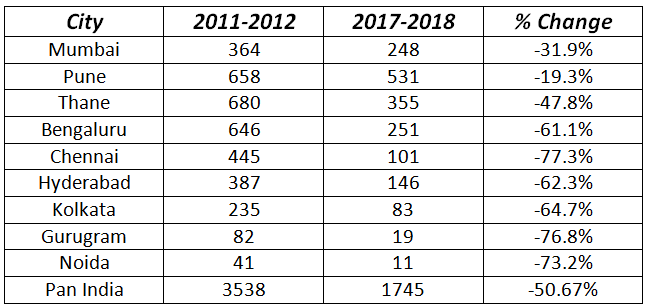

There has been massive consolidation of developers in the top 9 cities in India, with over 50% of the total developers that existed in 2011-2012 leaving the market by 2017-18, the report says.

Developers consolidated in Gurugram, Noida and Chennai has been to the amount of 70% since 2011 to date respectively. In Kolkata and Bengaluru in the past six years, the overall amount of developers has also been significantly reduced by more than 65%.

Also, during the same period, the total number of projects launched throughout the cities decreased substantially. The projected share of the top 10 developers grew through all the towns from 2011 to 2018 as a consequence of this strengthening. The overall amount of projects initiated by the top 10 developers in Gurugram and Noida today stood at 55% and 78%, respectively, compared to 28% and 52% in 2011. That shows obviously that the amount of projects initiated by the top 10 developers since 2011 by Noida and Gurugram has grown by 27%.

Why there is a decline in the number of small-developers?

Financial distress of small developers, lack of execution capability, oversupply of inventory, GST, demonetization, building excessive land banks, lack of understanding of demand and supply dynamics, unjustified price appreciation and the lack of social and physical infrastructure in emerging markets, are all distress-creating factors but when they occur together, it is a recipe for the perfect storm. It is interesting that in 2010 itself, this storm began to develop. The study said that there have been maximum launches in India between 2010 to 2013, leading to a large supply and consequent absorption being largely led by investors. This illusion of demand resulted to further launches and an enormous demand-supply mismatch, particularly in towns of tier-1 and in specific in the NCR. Because of the absence of intrinsic economic stability and consequent liquidity crunch, most unorganized developers struggled to perform. These small developers lacked the economic power to adjust to the current scheme and procedures.

“The impact of this storm today has resulted in the consolidation of developers across India. Every year, unorganized players failed to address the rising market problems, with the ultimate effect from RERA insisting on compliance with regulatory.” As a result, only reliable developers have appeared as the real beneficiaries that can efficiently meet the legislative requirements. The majority of smaller players have either left the industry or merged with bigger developers. That, in turn, advantages customers enormously because they are assured with a quality service within specified time limits and make a risk-averse buying choice.

Report on Number of Developers reduced in 2011-2018.

The number shows the replacement of smaller players by top developers in the market. “Consumers are now looking for developers whose quality and execution records are outstanding. The developer market is thus will be improved based on its sustainability in terms of deliveries and fair practices.”