List of Property Transaction in which PAN card is Mandatory.

By Abhay Harish Shah , Realty Quarter

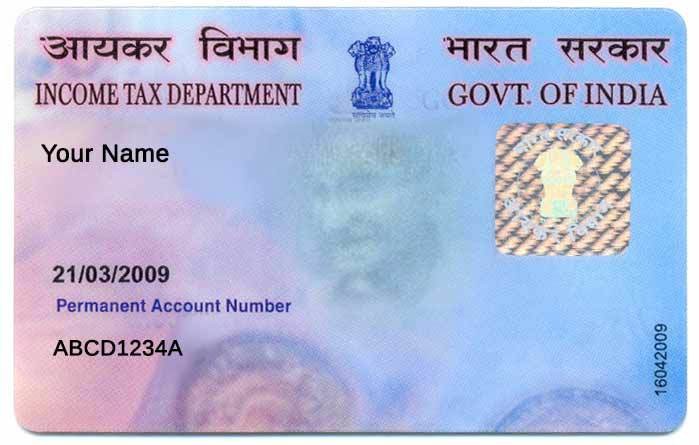

A PAN card of an individual has become an important document with fast computerization for many financial and non-financial transactions. This is just as important in buying, selling or leasing a property. For some transactions involving immovable property, a person’s Permanent Account Number (PAN) is compulsory.

Here’s a look at cases where it is required and the consequences of not providing this document.

1) While purchasing a property: You have to deduct a 1% tax at the moment of payment to the seller or builder, when you buy a property other than an agricultural land with a value exceeding Rs 50lakhs from a person who is Indian. In general, you will need a TAN (tax deduction account number) in order to deposit TDS (tax deducted from source).

Since the requirement to deduct tax on the acquisition of immobilized property is applicable to all taxpayers, individual taxpayers are exempt from a TAN under the law. Rather, you have to have a valid PAN, deposit the TDS, and adhere to the law.

2) To get credit for TDS on rental income: In the law a payer is required to deduct from rents tax at source at a rate of 10% if the amount of rent exceeds Rs 1.80lakhs in a year on a property, which is inherent in real estate (whether land, houses, commercial property or even factory premises). If the landlord does not provide his PAN, the occupant is required to deduct the rent tax at a rate of 20%. In addition, the host will not be credited for the TDS if the PAN is not provided.

Thus, an owner not submitting his PAN faces a double whammy whereas, the tax shall be deducted at 20%, rather than 10%, and the landlord shall not even receive the 20% TDS credit. Furthermore, the failure to inform the deductor of the valid PAN may result in a penalty of Rs 10,000 as required by law.

3) To receive income without deduction of tax at source: You can receive income without any tax deductions on the basis of the tax legislation, provided Form No.15G for less than 60 years, and provided Form No.15H for senior citizen. Forms 15 G and 15H are considered invalid if the form does not contain a valid PAN. The income payer shall, therefore, deduct from the rental tax at a rate of 20% higher.

In accordance with existing legislation, you can request your TDS officer to issue a certificate entitling you, at a rate lower than 10%, to receive rent without TDS. However, if you don’t mention the correct PAN, this form will also be treated as invalid.

In order to complete any transaction on real estate where the valuation exceeds Rs 5lakhs, you must also cite the buyer-seller PAN. The registrar who registers the document shall ensure that the permanent account numbers in the documents pertaining to the sale and purchase of the property are indicated. Thus, if the PAN is not provided, the registrar may reject the registration of the sale/purchase.

However, in the event you do not have a PAN, you may send Form 60 with the email evidence, such as ration card, passport, riding permits, etc.