Co-living space is trending and is more profitable then traditional leasing.

By Abhay Harish Shah , Realty Quarter

The co-living business sector is taking off in the Asia Pacific including India as more individuals relocate to urban areas for occupations or instruction openings. This is opening up new doors for realtors and financial specialists around the region.

More youthful ages, quick advancing buying patterns and the potential versatility in the Indian market is a genuine draw-card for new companies and developers hoping to enter the co-living business sector.

A co-living space is basically a set-up wherein individuals live respectively and share zones like kitchens, recreational rooms, lounges and balcony, yet have private rooms. This is a developing pattern in urban focuses as the populace increments due to financial elements.

With property costs ascending in urban cities, co-living offers inhabitants shorter and increasingly adaptable rent terms contrasted with condos, just as prepared to-move-in accommodation. As per a contextual investigation in the report, administrators could set aside to 25% in costs over the customary leasing model.

At the same time, investors also stand to benefit from significant savings. By working with co-living operators that play a multi-functional role – the building manager who handles maintenance, a property manager who collects rent and letting agent who sources for tenants – it eliminates the need to pay the three different layers of fees in a traditional residential property.

Mr Vijay Rajagopalan (Head Alternatives Business of JLL India) says “Co-living bridges a housing gap that traditional living categories do not support”. “Since co-living spaces are fully furnished with cleaning and maintenance services, tenants only need to deal with one operator instead of paying for deposits, utilities, furniture, and agent fees.”

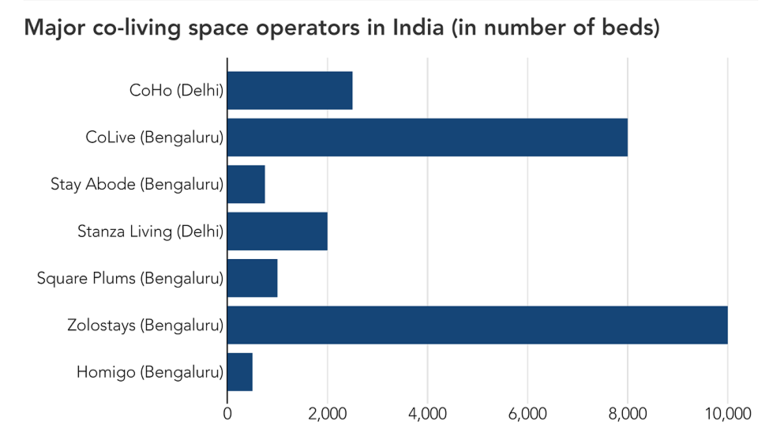

New businesses and small organizations have just started tapping this potential. A standout among India’s most esteemed new companies, OYO as of late reported its co-living vertical called OYO Living. Bangalore’s Zolo is at present crosswise over six urban areas with 16,000 beds, however, it means to cross 50,000 beds crosswise over India by the 2019-end.

Mr Nick Wilson (HCMR of JLL Asia Pacific) concludes “After some time, we’re probably going to see co-living take a higher piece of the overall industry in the Asia Pacific as occupants keep on driving interest and financial specialists pursue higher yields. Higher union action is additionally on the cards as little players will get consumed by greater players with progressively worked to suit items accessible in the market.”