Budget 2020: How it will benefit the real estate segment?

Budget 2020 has given the real estate industry and the common man many surprises. Many demands were anticipated from the real estate sector in the 2020 budget, but only a few received the attention of the minister of finance. Let us check some of the main budget announcements and their effect on the real estate industry.

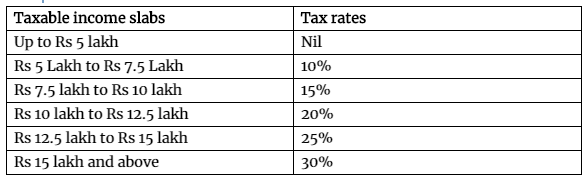

Dual Tax Slab Option:

To individual taxpayers, the government has announced a dual taxable option. Taxpayers may choose from the new tax and the existing tax slab option. Out of 100, 70 types of tax exemptions have been proposed to be abolished by the FM.

Tax Slab Format

“The most significant thing from the 2020 Budget is the tax relief for individuals.” The revised tax slabs ensure that the middle class has more disposable income. This could contribute to a reactivation of the real estate consumption process and the launch of the economy. “In addition, individual investments in housing and especially affordable housing may see a boom in the near future with additional savings,” says Spenta Corporation, MD. Farshid Cooper.

Some experts have differing opinions because they believe that the inefficiency of a housing loans deduction under the new optional individual tax system will serve as a significant dissuasion for those seeking to use housing loans.

Strengthening Liquidity

There is still no complete end to the liquidity crisis confronting NBFC/HFCs in 2019. Budget 2020 is expected to give a certain relief to the concept of further strengthening the credit guarantee scheme for NBFCs and HFCs.

“The government’s decision to start enhancing the NBFCs and HFC’s guarantee scheme and to provide subordinate debts to MSMEs is going to help at some degree to add liquidity to the sector alongside the abolition of DDT,” opines, chairman, The Guardians Real Estate Advisory, Kaushal Agarwal.

Infrastructure Development

In order to stimulate infrastructure development, the Finance Minister proposed multiple initiatives. Many projects have been revealed and large funds for industry and commerce have been allocated. “This year’s budget has announced the Government’s plans to improve infrastructure,” says Rahul Grover-CEO, SECCPL. The National Infrastructure Pipeline comprises of 6,500 countrywide projects as well as Rs 27,300 crores allocation for industry and trade in FY21 declared by finance minister Sitharaman. In parallel, plans have also been announced for the development of the national highways that can also contribute to the development of the real estate industry.

Tax benefit for Affordable Housing

In Budget 2019, the government introduced tax benefits under Section 80EEA for affordable home buyers, which were deductible from interest payments up to Rs 1.5 lakh. But the deadline was 31 March 2020. The FM announced in Budget 2020 that the benefit under section 80EEA will be extended to 31 March 2021.

“The Union Budget 2020-21 continued to focus the government on affordable housing by extending by one year, i.e. by March 31, 2021, the permitted additional interest deduction of Rs 1.5lakhs for loans borrowing from an affordable home valued up to Rs 45lakhs. Therefore, for one more year, the overall tax deduction for those interest payments remains at Rs 3.5 lakhs, which is expected to impact positively on-demand in the affordable housing segment.

- Affordable Homes

- Bangalore

- Chennai

- Current Affairs

- Delhi

- Expert Views

- Experts

- Features

- Housing Finance

- Housing Socieites

- INDIA / WORLD

- Infrastructure

- Interviews

- Investments

- Mumbai

- NCR Region

- New Projects

- News

- News Launches

- Other Cities

- Project

- Property Updates

- REAL ESTATE NEWS

- Realty_Quarter

- Residential property

Very informative post. I was looking for such kind of informative article for a long time and after reading your post I got exactly that what I want. Thanks a lot for sharing such post.

Thank you for making our writing a worth, we appreciate your words with a view to provide more interesting articles.